Wednesday, February 02, 2022 00:49:58 UTC

With government expenditure and borrowing continuing to rise, the latest Treasury Department data shows the United States national debt has reached $30 trillion.

The new record is for the entire outstanding debt of the federal government, which includes $23.487 trillion in public debt and an additional $6.525 trillion in intra-government debt, such as federal trust funds and other account.

A $5 trillion borrowing spree for pandemic relief was well underway before the coronavirus spurred an increase in Congress' spending at a regular pace.(More)

#spx #irs #treasurydepartment #debt #spending #pandemic #federal #trust #funds #covid

RELATED:

Fri, Apr 1, 22

What happened last night?

Wed, Feb 2, 22

Google 20-1 stock split

Wednesday, January 12, 2022 12:10:01 UTC

In 2022, Covid will not be the world's top public enemy. Inflation and the likelihood that policymakers dismiss the post-Covid rebound will be the major threats this year.

For most of 2021, policymakers at the Federal Reserve and many other central banks were confident in dismissing labor shortages and supply-chain bottlenecks as pandemic side effects. Lingering fear of Covid and those extra federal dollars in bank accounts were discouraging many of the unemployed from returning to work. The central banks reasoned that given enough time, these difficulties would be resolved.

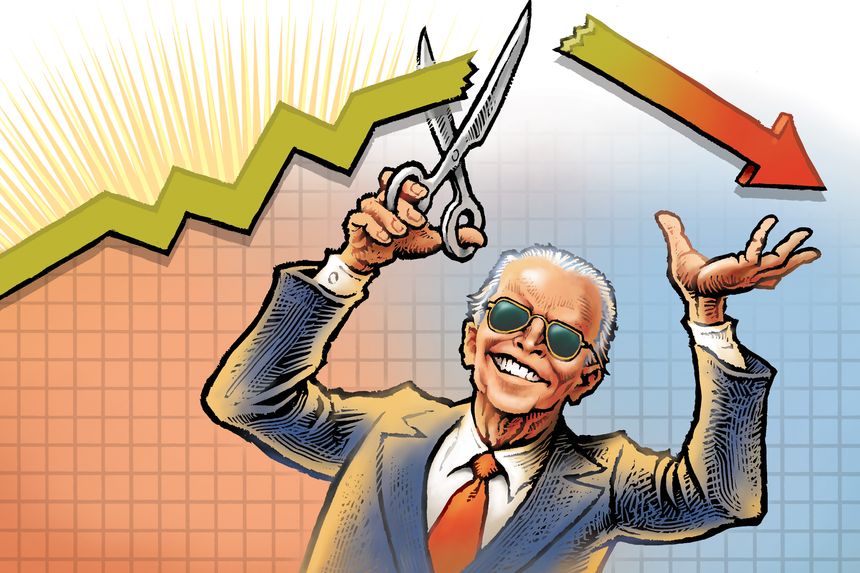

President Biden and his White House have not solved either issue.

The pandemic may have permanently altered the way we work and shop, but after the virus has been eradicated, the basic dynamics of demand and supply will swiftly return to normal. Then inflation will begin to return to the Federal Reserve's long-term target of 2%. If they're correct, officials will have avoided a recession by guiding the US economy to a smooth landing. If they are wrong, we shall all pay the price in 2023.(More)

INFLATION, NOT COVID, IS THE PROBLEM

Wednesday, January 12, 2022 12:10:01 UTC

In 2022, Covid will not be the world's top public enemy. Inflation and the likelihood that policymakers dismiss the post-Covid rebound will be the major threats this year.

For most of 2021, policymakers at the Federal Reserve and many other central banks were confident in dismissing labor shortages and supply-chain bottlenecks as pandemic side effects. Lingering fear of Covid and those extra federal dollars in bank accounts were discouraging many of the unemployed from returning to work. The central banks reasoned that given enough time, these difficulties would be resolved.

President Biden and his White House have not solved either issue.

The pandemic may have permanently altered the way we work and shop, but after the virus has been eradicated, the basic dynamics of demand and supply will swiftly return to normal. Then inflation will begin to return to the Federal Reserve's long-term target of 2%. If they're correct, officials will have avoided a recession by guiding the US economy to a smooth landing. If they are wrong, we shall all pay the price in 2023.

#pfe #mrna #pfizerinc #pfizer #moderna #vaccine #covid #inflation #federalreserve #joebide

Monday, December 27, 2021 12:04:55 UTC

European markets and U.S. futures rose this morning, amid light trading and a cautious atmosphere as traders assessed rising coronavirus infections.

Contracts in the United States edged higher after hitting an all-time high just before the Christmas holiday. While the UK market was closed, Europe's Stoxx 600 Index added to last week's gains. The value of Asian stocks has dropped.(More)

U.S. FUTURES RISE CAUTIOUSLY

Monday, December 27, 2021 12:04:55 UTC

European markets and U.S. futures rose this morning, amid light trading and a cautious atmosphere as traders assessed rising coronavirus infections.

Contracts in the United States edged higher after hitting an all-time high just before the Christmas holiday. While the UK market was closed, Europe's Stoxx 600 Index added to last week's gains. The value of Asian stocks has dropped.

#dow #spy #amzn #shop #dowinc #thefederalreserve #tapering #bonds #stocks #covid

FED DOUBLES TAPER TO $30B A MONTH

12.15.21 7:36 PM UTC

The Federal Reserve announced plans to accelerate the wind down of its aggressive bond-buying program and signaled at least three interest rate hikes next year.

FED DOUBLES TAPER TO $30B A MONTH

Wednesday, December 15, 2021 19:36:25 UTC

The Federal Reserve announced plans to accelerate the wind down of its aggressive bond-buying program and signaled at least three interest rate hikes next year.

#thefederalreserve #tapering #bonds #stocks #ratehikes #pandemic

BOEING STAFF GET VAXED OR GET FIRED

10.13.21 5:20 PM UTC

Boeing staff must be vaccinated by December 8 or they'll be fired. New Biden law includes federal employees and those who do business with the federal government.

BOEING STAFF GET VAXED OR GET FIRED

Wednesday, October 13, 2021 17:20:49 UTC

Boeing staff must be vaccinated by December 8 or they'll be fired. New Biden law includes federal employees and those who do business with the federal government.

#boeing #covid #vaccination #federalemployees #protest #joebiden

U.S. WON'T BAN CRYPTO

10.6.21 12:57 AM UTC

SEC Chairman Gary Gensler said that the U.S. will not ban cryptocurrencies, but will see that the industry is regulated.

U.S. WON'T BAN CRYPTO

Wednesday, October 06, 2021 00:57:46 UTC

SEC Chairman Gary Gensler said that the U.S. will not ban cryptocurrencies, but will see that the industry is regulated.

#crypto #bitcoin #garygensle #jeromepowell #robinhood #federalreserve

WHAT HAPPENED LAST NIGHT?

N/A

A massive options trade may be the culprit for the S&P dump just before market close Thursday afternoon.